36+ Tt&L Calculator Texas

250000 Taxes and fees. Im trying to figure out final financing and down payments but TESLA does things a little different.

Functional Electrical Stimulation Fes Resource Guide Pdf Free Download

Find your state below to determine the total cost of your new car including the car tax.

. 625 percent of sales price minus any trade-in allowance. Treasury Tax and Loan Service or TTL is a service offered by the Federal Reserve Banks of the United States that keeps tax receipts in the banking sector by depositing them into select banks that meet certain criteria. Payment Price Total purchase price before tax 0 1k 10k 100k Monthly payment.

In most counties in Texas the title fee is around 33. You can also examine your complete amortization schedule by clicking on the View Report button. TTL fees for all 50 states will be available in 2019.

5175 base fee 10 local fee Adding the above figures together will get you the total tax title and license fee expenditure that you can expect on your new ride. How do you calculate sales tax on a car in Texas. A rebate will reduce your auto loan balance while low interest financing lowers your monthly payment.

Web Use our Auto Loan Calculator to find out. In addition AIB is working with the American Association of Motor Vehicle Administrators AAMVA to become a Certified data provider of the National Motor. Buying Guides Share How Much Does Tax Title and License Cost.

The payment is based on a net vehicle price of 38250 plus Texas state fees plus extended warranties. Web How Much Is Tax Title And License In Texas. Web Texas DMV State Fees.

For instance if a vehicle is sold at 20000 the sales tax is calculated by multiplying 20000 by 625 percent. Web In Texas the title fee is 33 in most of the counties. Some state representatives want to cap rates while cities and counties oppose that measure.

Web If the owner purchases a new vehicle from an individual the owner should use the highest of 80 percent of the certified appraised value of the vehicle or the purchase price or the vehicles standard presumptive value. Web Use this calculator to help you determine your monthly car loan payment or your car purchase price. Web Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator.

Web A car payment with Texas tax title and license included is 68172 at 499 APR for 72 months on a loan amount of 42255. Web The DMV Fee Calculator currently provides TTL fees for each County or Parish in Texas Arkansas Louisiana and New Mexico. The standard presumptive value is the average used vehicle price based on Texas sales data.

You can enter the city and county you live in and then will be given the rate of taxation for that location. 28 to 33 varies by county Tag License Fee. By Melissa Spicer July 13 2022 Nationwide Americans pay tax title and license fees to the tune of around 669 per year according to AAAs annual Your Driving Costs study.

Your average tax rate is 1167 and your marginal tax. Property tax rates have become a contentious issue between local governments and the state. Web What is TTL in Texas.

625 of the total vehicle purchase price. TTL accounts are Treasury accounts created at commercial banks to accept electronic tax payments and. Since vehicles are sold at differing purchase prices the sales tax amount will differ likewise.

Standard Fee - 33. Web SmartAssets Texas paycheck calculator shows your hourly and salary income after federal state and local taxes. This way you can figure your taxes by the amount you are giving for the vehicle multiplied by the rate of taxes then add it together for your total tax.

Web Title Transfer Fee. Fees one can expect to pay when buying a car in Texas are as follows. After you have entered your current information use the graph options to see how different loan terms or down payments can impact your monthly payment.

Web How much are tax title and license fees in Texas for a new car. Standard Fee - 5075 per year. Web Treasury Tax and Loan.

Web Texas taxes on a pack of 20 cigarettes totals 141 which ranks in the middle of the pack on a nationwide basis. Ready to take the next step. Here are the state DMV fees in Texas when it comes to registering and titling a vehicle.

You can preview the full SPV of a used vehicle by entering the vehicle identification number VIN and odometer reading not needed for motorcycles in the boxes below. MY SA texted me and said TTL is taken care of by me about a month after pickup. Texas residents 625 percent of sales price less credit for sales or use taxes paid to other states when bringing a motor vehicle into Texas that was.

Term in months 12 48 84 120 Interest rate 0 8 17 25 Down payment. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. Web Estimate your monthly car payment with our payment calculators.

Get pre-qualified with no impact to your credit score. Car payment is 29668 per month. I got my VIN yesterday and my EDD is now May 31-Jun4.

Vehicles 6001 to 10000 pounds - 5400 per year. Fees for Titles licenses and taxes can differ depending on several factors. Use this calculator to help you determine whether you should take advantage of low interest financing or a manufacturer rebate.

If you make 70000 a year living in Texas you will be taxed 8168. 5175 base fee 10 local fee. For the sales tax of both new and used vehicles to be paid it is calculated by multiplying the cost of buying the car by 625 percent.

Vehicles Over 10000 pounds - Based on the weight of the vehicle. Web Black Book the national guide that provides the values uses an average wholesale used vehicle value based on Texas sales data. Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard presumptive value SPV whichever is the highest value.

28 to 33 varies by county Tag License Fee. Web How Much Does Tax Title and License Cost. Web The best way to figure these taxes is to go to the website for taxes in Texas.

The net price comes from the sale price of 39750 minus the rebate of 1500. Enter your info to see your take home pay. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

The sales tax on both new and used vehicles is calculated by multiplying the cost of the vehicle by 625 percentage. Web Texas Income Tax Calculator 2022-2023.

Nms November 2011 By Livestock Publishers Issuu

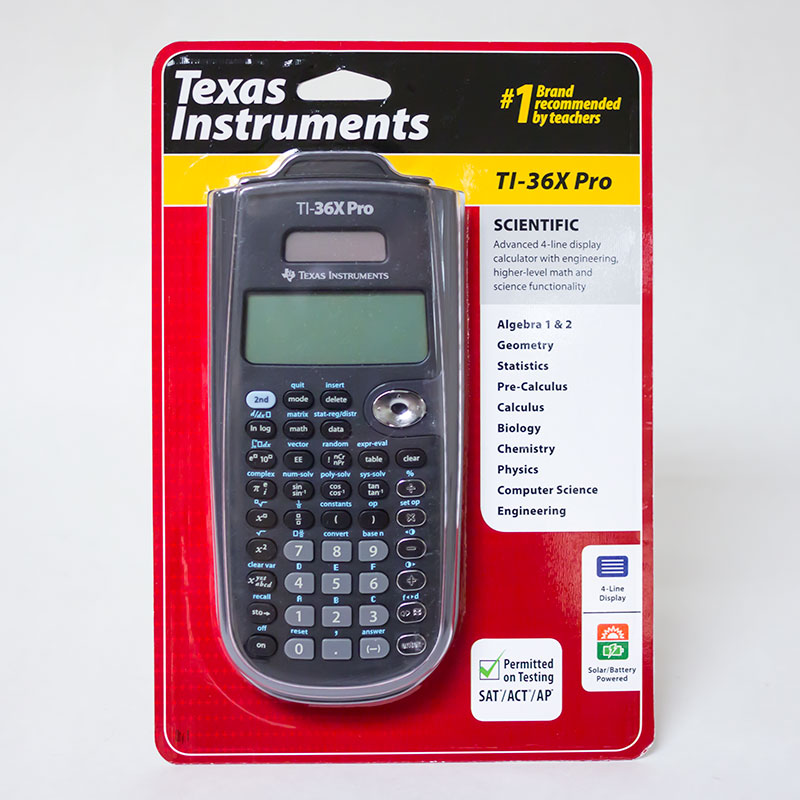

T I 36x Pro Scientific Calc Ti36xproca

Ti 36x Pro Scientific Calculator Texas Instruments

The Fees And Taxes Involved In Car Leasing Complete Guide

What Is The Washington State Vehicle Sales Tax

How Much Are Vehicle Tax Title And License Fees In New Mexico

Texas Sales Tax Calculator And Local Rates 2021 Wise

Auto Loan Calculator Associated Credit Union Of Texas

Auto Loan Calculator Monthly Car Loan Payment Calculator

Ti 30xb Multiview Scientific Calculator Texas Instruments

Missouri Car Sales Tax Calculator

Brand New Original Texas Instruments Ti 36x Pro Multifunctional Student Scientific Calculator Hot Selling Graphing Calculator Aliexpress

Texas Sales Tax Calculator And Local Rates 2021 Wise

Car Sales Tax Tags Calculator By State Dmv Org

Texas Instruments Ti 36x Pro Calculator University Store

How To Find Roots On The Ti 36x Pro Calculator Youtube

Payment Calculator Official Site Of Ford Credit